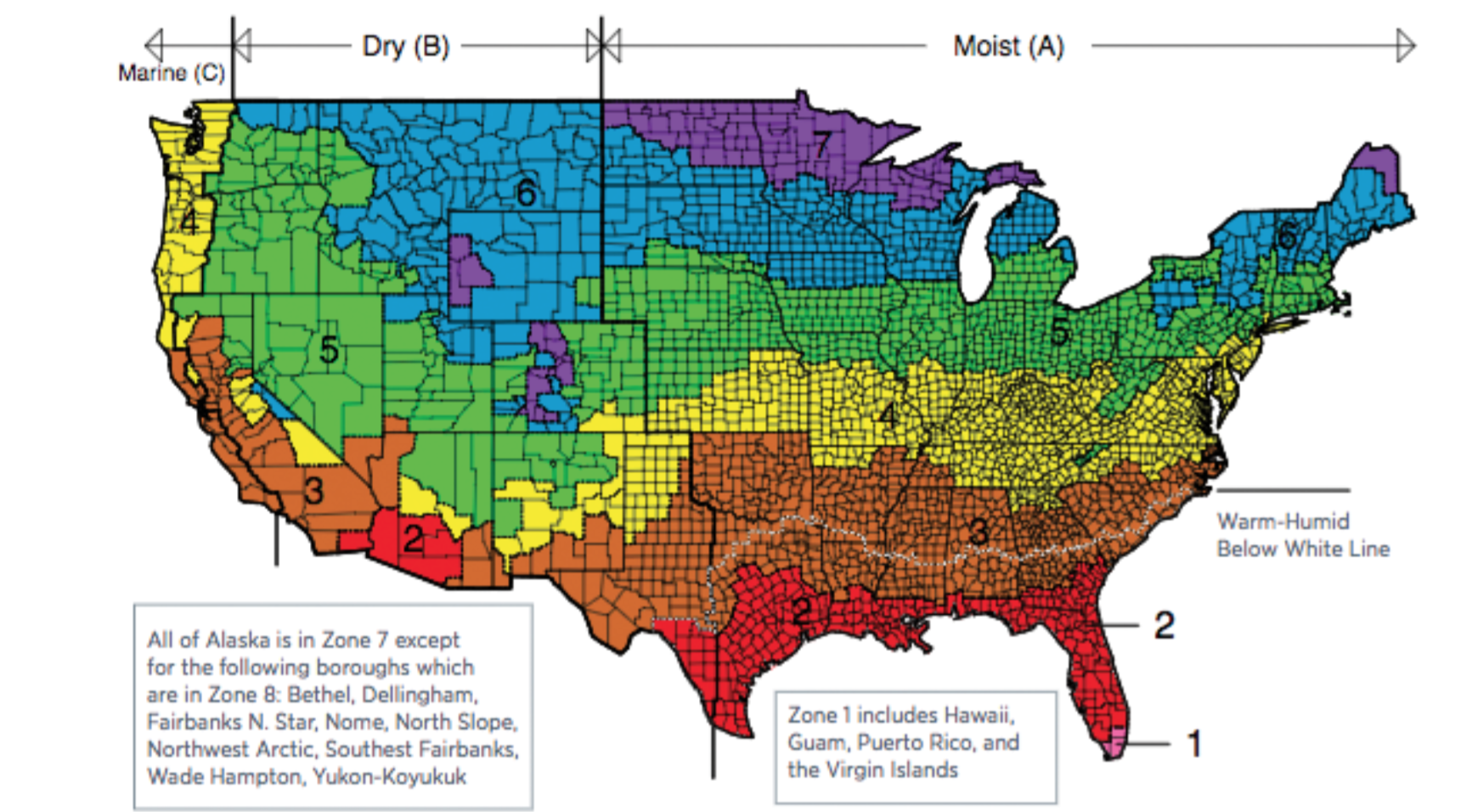

New Study Confirms Energy-Efficient Replacement Roofs Save Energy and Reduce Costs and Carbon Emissions

A new study, completed by the globally-acclaimed technology services and consulting firm ICF International, demonstrates that code-compliant levels of roof insulation installed entirely above deck…