Early in the evening hours of June 12, 2014, Abilene, Texas, was hit by a hailstorm that covered approximately 40 percent of the town.

Some residents reported multiple deck and ceiling punctures with several homeowners reporting stones that penetrated deck and ceiling to smash flat-screen TVs. The damage covered most of the downtown business district; Hardin Simmons and Abilene Christian universities; and a large regional hospital complex, including outlying medical and laboratory facilities. Auto damage was severe and widespread, exacerbated by the large number of visitors gathered downtown for a popular monthly event. There were a few injuries, but no deaths, other than some animals at the local zoo. Initial damage estimates topped $400 million, a sizeable amount for a town of 100,000.

Hailstorms are not unknown in our area though not as common as might be assumed. Since I have been in the roofing business, we have had damaging hails in 1967, 1973, 1988, 2011 and 2014. Our company, now in its 124th year, did not keep records of storms prior to 1967. It has been my experience that no two storms are alike, each taking on a life of its own with regard to how the insurance industry reacts. The last several years, Texas has had major storms in a number of areas, including Amarillo, the Dallas-Fort Worth Metroplex, Austin and Rio Grande Valley. In these areas, roof claims litigation has exponentially increased, driven by a cottage industry of public adjusters, roof consultants, restoration contractors and attorneys, all making a business of inserting themselves between the insurance carrier and the building owner/policy holder. While there can be legitimate need for all these people at times, it does appear some may have crossed the ethical line to shake down insurance carriers with inflated claim demands.

The last several years, Texas has had major storms in a number of areas, including Amarillo, the Dallas-Fort Worth Metroplex, Austin and Rio Grande Valley.

We experienced a little of this activity during our 2011 hail, but it was limited because the hail coverage area included few commercial properties. I was personally aware of several claims made in areas where there was no hail and the damages claimed far exceeded the value of the building.

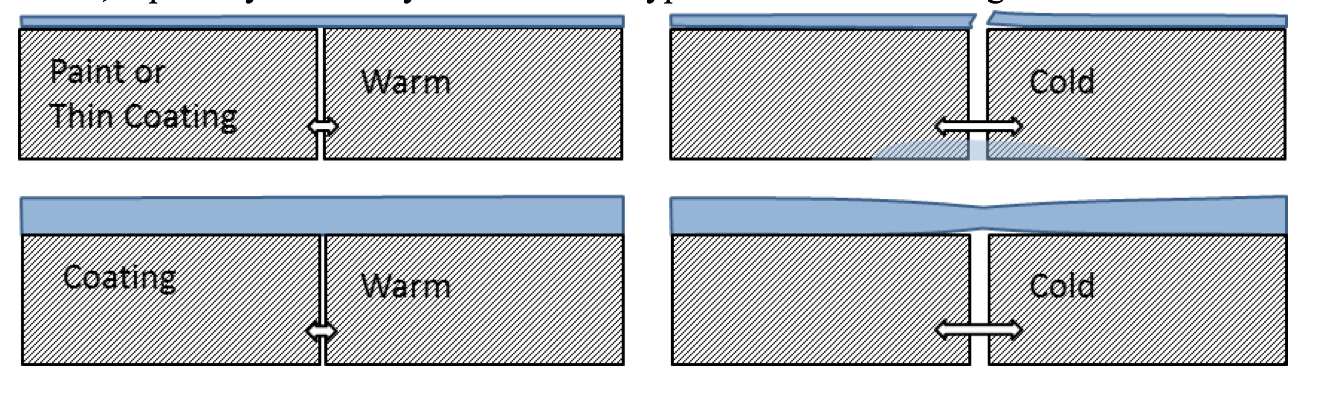

In response to these perceived abuses, the insurance industry in 2014 has become much more aggressive in its claims handling, especially with gravel-surfaced built-up roofs. Gravel-surfaced roofs remain a significant portion of the roof inventory in this market. Adjusters have been paying for modified bitumen and metal roofing without too much argument. But, since the June hail, we have looked at dozens of buildings with gravel-surfaced roofs that, in our opinion, should be total losses, only to have the adjuster, who is often only vaguely familiar with gravel roofing balk at paying and call in consulting engineers to take sample cuts for lab analysis.

So far, it appears that in the absence of multiple punctures, the assumption by adjusters is that there is no damage—or at least damage short of a total loss.

My suspicion is that it will become much more difficult and expensive to insure commercial roofing, with limits on coverage, much higher deductibles and more specific language to define what is damage. The real loser will be the building owner, forced to assume a much larger portion of the risk.

PHOTOS: JERRY SIEWERT

Be the first to comment on "Commercial Roofs Will Be More Difficult and Expensive to Insure"